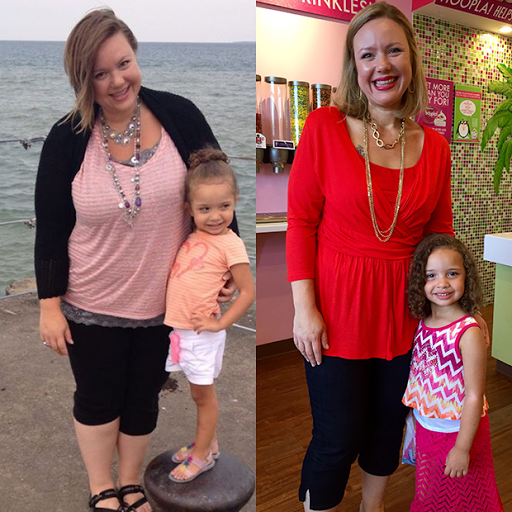

A trip to Disney World 10 years ago unexpectedly changed life of this 32 year old administrative assistant Victoria Wagar. During that trip, she had been ordered off a roller coaster at the famed theme park when the safety bar wouldn’t close. She was simply too fat. But, when she recently planned another visit to the amusement park, this time with her 4 year old daughter, there was no way she wanted that to happen again.

With that trip to Disney World on the calendar, she decided it was finally time to make a change. For someone who had been overweight for as long as she could remember, shrinking her 350 pound frame wasn’t a simple suggestion.

“There wasn’t a day that went by that I didn’t think about the fact that I was overweight,” she remembers. “I always compare it to any addiction: I couldn’t stop eating and always made the choice to eat the wrong things, even though I knew it was wrong.”

Despite the odds, Victoria has managed to lose a whopping around 75 kilos in a little less than a year and a half. This wasn’t the result of a trendy diet, an expensive gym membership or even surgery. victoria's key to weight loss success was a direct result of educating herself about healthy habits and tracking every food she ate and step she took. Here’s how she did it:

1. Good Decisions

After signing up for The 3 week diet system in March 2014, Victoria dove headfirst into learning how to lead a healthier life. “I used the System, read the blogs and took tips from those,” she says. “I gradually added more fresh fruits and vegetables, but it didn’t happen overnight. I found that one good decision leads to another.”

2. Initiate a Logging Streak

Previously, Victoria never had any idea of how much and what kinds of foods she should be eating, much less a daily calorie goal. Over time, she was able to determine what made sense for her as an individual. In order to make sure she was hitting her goals, she found that logging her meals was imperative.

“I’ve logged in for more than 500 days in a row now,” she says. “When I started losing weight, I felt so good, so that was a major incentive.”

Even in those early days before she made any big changes to her diet, she said that logging came in handy. “The first couple of times I put food in the log, I couldn’t believe the calories,” she explains. “Even if you’re not going to change anything, get in there and log what you’re eating and it’ll really make you think. Sometimes I even use it as a research tool by putting something in to see how many calories it has before I eat it.”

victoria discovered that logging exercise was equally motivating. While she could initially walk around her neighborhood only one block at a time, she has progressively been able to add time to her walks as the weight came off.

“Holding yourself accountable no matter what is key,” she says. “I really recommend tracking your steps so you can see how much you’ve moved. Now my day isn’t the same if I don’t work out.”

3. Prioritize Caring for Yourself

Along with increased motivation came self-control for Wagar. “I had to tell myself that if I can get up every day and brush my teeth, I can do this: I’m worth it. I’m going to choose to take care of myself,” she says.

She found greater self-control by planning ahead. She now goes to the supermarket with a list for the week’s groceries so she’s not caught in a moment of hunger without healthy options. On Sunday nights, she has fruits and vegetables cut and ready to eat, dinner in the Crock-Pot and lunches packed for the week.

To be sure, her newfound healthy lifestyle doesn’t mean that she never eats the foods that she once loved. “I will have a burger at a cookout, for instance, but I will also bring a caprese salad and load up my plate with that,” she says. “Even if you do have a bad day, you still have to hold yourself accountable; log it, and move on.”

As someone who has waged a lifelong battle with weight issues, Wagar hopes that her story can serve as inspiration to others. “People always ask, ‘What’s your secret?’ But it’s not a secret. It’s diet, exercise with this system,” she says. “It has really changed everything—every relationship, my job. I’m just so happy.”